Business Ideas

Explore trending startups & innovative ventures.

Tech Trends

Stay ahead with latest tech insights & gadget reviews.

Wellness Tips

Boost your well-being with holistic health hacks.

Kampung Bloggers Stories

Ultrafine Copper Powder: Benefits & Uses

Welcome to our comprehensive guide on ultrafine copper powder. In…

A Brief Discussion On Ultrasound Scan

An ultrasound scan is an imaging technique that holds diagnostic…

Crafting Success: The Role of Purchased Instagram Likes and Followers in Growing Artisanal and Handmade Businesses

Introduction: In today's computerized age, online entertainment has changed the…

What to Do If You Suspect a Gas Leak in Your Home in Riverside, CA

Identifying Signs of a Gas Leak Recognizing the early signs…

Understanding Google My Business Insights and Analytics

Google My Business (GMB) has end up an quintessential tool…

Can Stress Cause Hair Loss? Find Solutions with Vitamins Revive

Stress is a common affliction in today's fast-paced world, impacting…

Telefoon Reparative: Quick Fixes for Common Device Issues

"Struggling with phone troubles? Discover easy solutions for common telefoon…

Vograce Custom Pins Can Help You Express Yourself More Stylefully

The popularity of Custom pins has increased due to their…

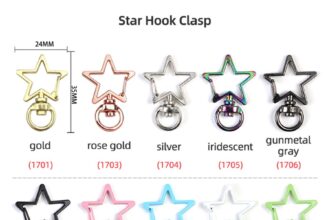

Unlocking the Potential of Keychain Accessories

In the realm of everyday carry essentials, keychain accessories stand…

Discover the Allure of Acrylic Keychains and Custom Keychains

Keychains are more than mere tools for keeping keys organized…

The Versatility and Durability of Custom Vinyl Stickers: A Must-Have for Your Brand

In today's fast-paced world, businesses need to find innovative ways…

Hannahoetzel2: Unveiling the Authenticity of Social Media Sensation

In the vast expanse of the digital universe, where filters…

Unlocking the Power of Hydrogen Fuel Cells: Revolutionizing Energy Storage

In a world increasingly conscious of environmental sustainability and the…

Innovative Protective Solutions for Sensitive Medical Machinery

Modern medicine relies on sensitive machinery. Doctors, nurses, and more…

The Power of Personalization: Custom Logo Watches in Marketing Campaigns

In the dynamic world of marketing, where brands constantly seek…

What Kind Of Existence Is The Statue Behind Maliketh’s Arena In Elden Ring DLC?

Since the release of Elden Ring DLC trailer, we've spent…

How are Apps and Software Streamlining Processes for Packers and Movers?

The digital era (what we are currently in) is reshaping…

The Power of Hygetropin HGH: Transforming Lives Through Hormonal Balance

In the space of flourishing and accomplishment, the mission for…

Anabolic Steroids: FAQs

Bodybuilding and steroids are hot topics of discussion among both…