Forex trading, also known as foreign exchange trading, is a global marketplace where currencies are bought and sold. One of the fundamental concepts in Forex trading is the classification of currency pairs into two categories: major pairs and minor pairs. In this blog post, we will focus on major pairs, providing a clear definition and step-by-step guidance on how to trade them. Major pairs are the backbone of the Forex market, involving some of the world’s most traded currencies. Understanding how to navigate major pairs is essential for any aspiring Forex trader. Let’s dive in and explore the world of major currency pairs.

What Are Major Pairs?

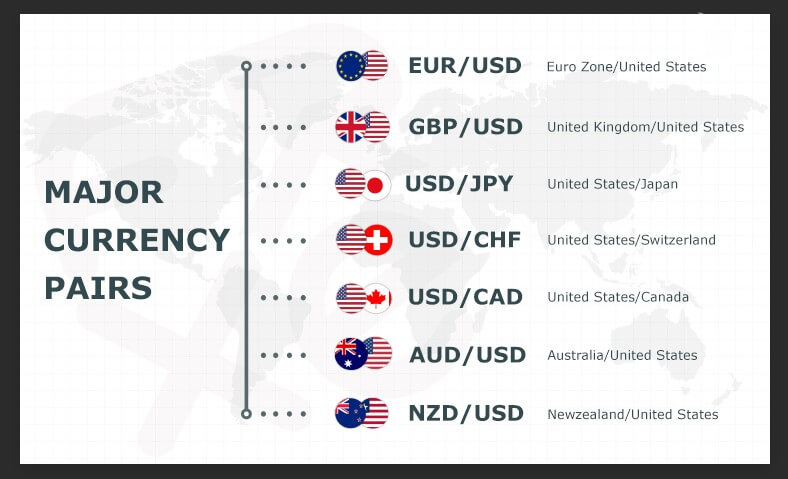

Major pairs are currency pairs that involve the most liquid and widely traded currencies globally. These pairs always include the US Dollar (USD) on one side. The reason behind their prominence is the stability and strong economic backing of the countries whose currencies are involved. The major pairs include EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CHF, and USD/CAD. For Crypto Signals 2023, it’s important to note that major currency pairs are a well-established concept in traditional foreign exchange markets, whereas crypto signals pertain to the volatile and rapidly evolving world of cryptocurrency trading.

Why Trade Major Pairs?

Trading major pairs offers several advantages for both beginner and experienced Forex traders. They are known for their liquidity, which means you can buy or sell them at any time without significant price fluctuations. Additionally, major pairs tend to have lower spreads, making them cost-effective for traders.

Understanding Currency Pairs

Before delving deeper into trading major pairs, it’s crucial to understand the structure of currency pairs. Each currency pair consists of two currencies: a base currency and a quote currency. In the EUR/USD pair, for example, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

Factors Affecting Major Pairs

To trade major pairs effectively, you must be aware of the factors that influence their exchange rates. These factors include economic indicators, central bank policies, geopolitical events, and market sentiment. Staying informed about these elements will help you make informed trading decisions.

Choosing the Right Major Pair

Selecting the right major pair to trade is crucial for success in Forex trading. It’s recommended to focus on a few major pairs initially rather than trading all of them. Consider factors like economic stability, interest rates, and geopolitical stability when choosing a pair that suits your trading strategy and risk tolerance.

Technical Analysis for Major Pairs

Technical analysis is a valuable tool for trading major pairs as well as trading crypto pairs. It involves studying historical price charts and using various indicators to identify potential entry and exit points. Common technical analysis tools include moving averages, RSI, MACD, and trendlines. Whether you’re trading major currency pairs or trading crypto pairs, technical analysis can help traders make informed decisions in both traditional and cryptocurrency markets.

Fundamental Analysis for Major Pairs

Fundamental analysis involves examining the economic and political factors that affect a currency’s strength. For major pairs, this often includes monitoring economic data such as GDP growth, employment rates, and interest rates. Additionally, keep an eye on central bank statements and geopolitical news that can impact currency values.

Risk Management Strategies

Successful trading of major pairs requires effective risk management. Implement strategies like setting stop-loss orders to limit potential losses and using proper position sizing. Never risk more than you can afford to lose in a single trade.

Practice with a Demo Account

Before trading major pairs with real money, it’s wise to practice on a demo account. Most Forex brokers offer demo accounts where you can trade with virtual funds, allowing you to gain experience without risking your capital.

Continuous Learning and Adaptation

The Forex market is dynamic, and trading major pairs successfully requires continuous learning and adaptation. Stay updated on market news, refine your trading strategies, and be open to adjusting your approach as market conditions change.

Conclusion

Major pairs in Forex trading are the cornerstone of the global currency exchange market. Understanding their definition, advantages, and how to trade them is essential for any trader looking to navigate the world of Forex. By focusing on liquidity, conducting thorough analysis, and practicing sound risk management, you can increase your chances of success when trading major currency pairs. Remember that Forex trading involves risks, so always trade responsibly and consider seeking advice from financial experts if needed. With dedication and knowledge, you can harness the potential of major pairs to achieve your trading goals.