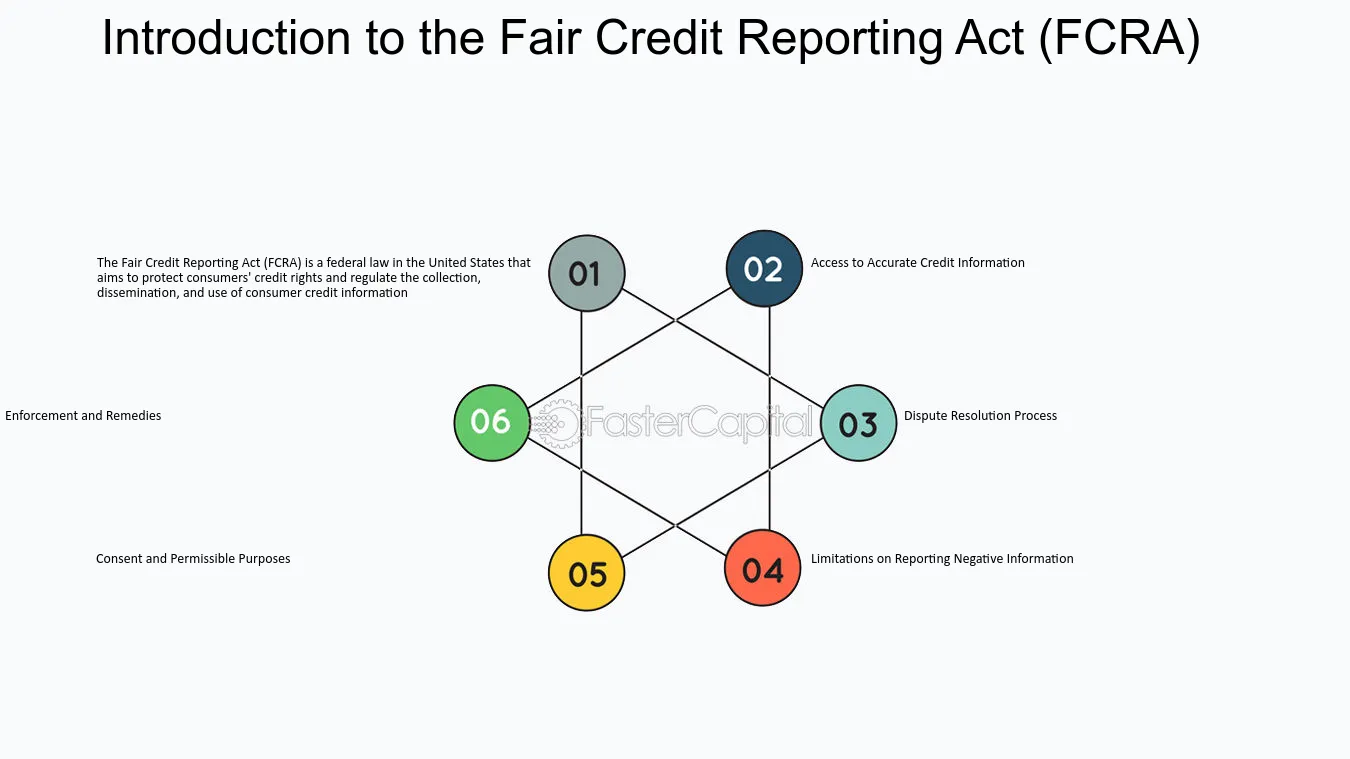

The Fair Credit Reporting Act (FCRA) is a vital piece of legislation designed to protect consumers’ rights and ensure the accuracy and fairness of information contained in their credit reports. Understanding your rights under the FCRA is crucial for maintaining a healthy credit history and safeguarding your financial reputation. In this article, we will provide a step-by-step explanation of your rights under the FCRA, empowering you to take control of your credit information with the guidance of fair credit reporting act lawyers.

Step 1: Obtain Your Credit Report

Your journey under the FCRA begins with obtaining a copy of your credit report. You are entitled to one free credit report every 12 months from each of the major credit reporting agencies – Equifax, Experian, and TransUnion. To access your reports, visit AnnualCreditReport.com, the only authorized source for free credit reports.

Step 2: Review Your Credit Report Thoroughly

Once you have your credit reports, scrutinize them carefully for inaccuracies, discrepancies, or fraudulent information. Check for errors in personal information, account details, and payment history. Ensure that all the accounts listed belong to you, and that the reported credit limits and outstanding balances are accurate.

Step 3: Dispute Inaccuracies

If you identify inaccuracies or discrepancies in your credit report, the FCRA empowers you to dispute these errors. Write a formal dispute letter to the credit reporting agency, clearly outlining the inaccuracies and providing any supporting documentation you may have. The agency is obligated to investigate your dispute within 30 days and correct any errors found but seeking guidance from a Florida Fair Credit Reporting Act Attorney can offer legal insight and support in navigating this process.

Step 4: Investigate and Correct Inaccuracies

The credit reporting agency will investigate your dispute and communicate with the information provider (the entity that reported the disputed information). If inaccuracies are confirmed, the agency must correct your credit report. You have the right to request a corrected copy of your report and have the corrected information sent to anyone who received your report in the past six months (or the past two years for employment purposes).

Step 5: Place a Fraud Alert

If you suspect or discover fraudulent activity on your credit report, you have the right to place a fraud alert. This alert notifies creditors and lenders that they should take extra precautions before extending credit in your name. Contact one of the three major credit reporting agencies to initiate a 90-day fraud alert, which can be extended if needed.

Step 6: Place a Security Freeze

For added protection, you can place a security freeze on your credit report, restricting access to your credit information. This prevents new creditors from viewing your credit report, making it challenging for identity thieves to open accounts in your name. To place a freeze, contact each of the credit reporting agencies individually, and consulting a fair credit reporting act lawyer can provide legal guidance and support in understanding your rights in this process.

Step 7: Opt-Out of Prescreened Credit Offers

The FCRA allows you to opt-out of receiving prescreened credit offers, which are pre-approved credit or insurance offers based on information in your credit report. To opt-out, visit OptOutPrescreen.com or call 1-888-5-OPT-OUT.

Step 8: Know Your Rights Regarding Employment Reports

If an employer takes adverse action against you based on information in your credit report, they must provide you with a copy of the report and a summary of your rights under the FCRA. You have the right to dispute inaccuracies in the report and seek corrections.

The Fair Credit Reporting Act is a powerful tool that empowers consumers to take control of their credit information. By understanding and exercising your rights under the FCRA, you can ensure the accuracy of your credit reports, protect yourself from identity theft, and maintain a strong financial standing. Stay vigilant, review your credit reports regularly, and take prompt action to address any inaccuracies – your financial future depends on it.